Feb 09, 2012: Have you ever wondered about the fact that even after a decade long relationship, sometimes it seems that we hardly know the other person! Sounds familiar isn't it? If the behavior of a single human being can be so unpredictable then what is our take about the cumulative behavior of millions of investors all over the world? Our observation is that such behavior is utterly unpredictable and apparently irrational!

Feb 09, 2012: Have you ever wondered about the fact that even after a decade long relationship, sometimes it seems that we hardly know the other person! Sounds familiar isn't it? If the behavior of a single human being can be so unpredictable then what is our take about the cumulative behavior of millions of investors all over the world? Our observation is that such behavior is utterly unpredictable and apparently irrational!We sometimes ponder and try to speculate the market. Basically we try to time the market to maximize our gains. Often we give up in despair! There are so many factors to be taken into account, volumes of information to be considered (not all of them are all reliable either) and finally there is a humongous number of unknown parameters that may influence the market! How on earth does one tackle all that?

We believe it's simply not possible to successfully time the market consistently over a long period of time. We have friends who try to do so. They hope to profit on the upswing and sell out during the downward movement of the market. Then there are those who get in and out at the drop of a hat aka the average impulsive investors.

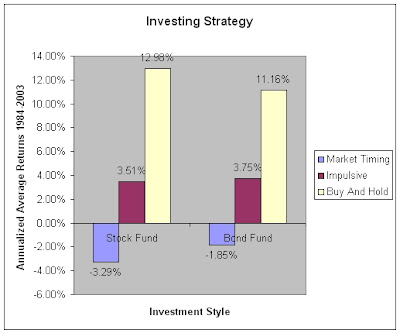

Which strategy do you think is the most rewarding: buy and hold, impulsive or market timing? Here is some evidence to enlighten us in this regard. Let us study the following chart.

- It depicts annualized average returns for a 20 year period from 1984 to 2003.

- Three different investor behaviors are considered - buy and hold, impulsive and market timing.

- The first set of bars show investments made in a 100% stock mutual fund.

- The scenario for investing in a 100% bond mutual fund is shown in the second set.

- Inflation has not been accounted for. Average annual inflation for 1984-2003 was 3.1%.

- Buy and hold investor simply bought a S&P 500 Index fund for stocks and Lehman Brothers Long Term Government Bond Index fund for bonds.

- Dividends were reinvested.

Surprising isn't it? Not once in our wildest imaginations did it occur to us that market timed investing would be the worst performer. But this set of data says so! Amusingly we notice that the average impulsive investor did better than those who tried to time the market!

Surprising isn't it? Not once in our wildest imaginations did it occur to us that market timed investing would be the worst performer. But this set of data says so! Amusingly we notice that the average impulsive investor did better than those who tried to time the market!We encourage you to do your own research and determine a suitable strategy for yourself. It would be extremely interesting to know about your findings. Please share your opinions with us.

Data Source(s): Dalbar Inc., Quantitative Analysis of Investor Behavior, 2004.

Image Source(s): iStockPhoto