[This post is written and copyrighted by FIRE Finance (http://firefinance.blogspot.com).]

Oct 20, 2008: The subprime mortgage fiasco's blow to the economy along with recent failures in the investment banking industry have led to closure of several big companies. Consequently we are seeing huge layoffs and a rise in unemployment rates. Times are difficult for those who have lost their jobs and also for those who have lost their homes. No matter what the causes are, people are going through tough times and our prayers are with them for overall well being in all aspects of life. Often we have seen that if we hold cheerful expectations from life sooner or later they become true. So let us all be enthusiastic about the economy bouncing back and people finding satisfying employment opportunities.

Oct 20, 2008: The subprime mortgage fiasco's blow to the economy along with recent failures in the investment banking industry have led to closure of several big companies. Consequently we are seeing huge layoffs and a rise in unemployment rates. Times are difficult for those who have lost their jobs and also for those who have lost their homes. No matter what the causes are, people are going through tough times and our prayers are with them for overall well being in all aspects of life. Often we have seen that if we hold cheerful expectations from life sooner or later they become true. So let us all be enthusiastic about the economy bouncing back and people finding satisfying employment opportunities.

As Americans we often find ourselves in a tough spot of having the responsibility to save for a healthy retirement without any clear notion of how much to save. To add to that, layoffs or the time between jobs, often make it hard to save. There are certain rules of thumb about saving which can give a general guideline about saving:

As Americans we often find ourselves in a tough spot of having the responsibility to save for a healthy retirement without any clear notion of how much to save. To add to that, layoffs or the time between jobs, often make it hard to save. There are certain rules of thumb about saving which can give a general guideline about saving:

The April issue of the Journal of Financial Planning features an interesting study: "National Savings Rate Guidelines for Individuals [1]". It takes into consideration age, income and retirement savings till date to compute the rate of saving required to reach a comfortable retirement. It also creates benchmarks for how much capital an individual would have accumulated based on their income and age, with the presumption that they started saving at age 35. Additionally, it shows targets for how much an individual should have accumulated at age 65, prior to retiring [2].

Your gross salary minus the amount you're putting away for retirement is defined as net pre-retirement income. The study calculates how much money you'll need in addition to Social Security income at age 65 to maintain your standard of living. The authors simplify matters by assuming full Social Security benefits are available at age 65. However, they urge readers to wait in reality until full retirement age to get the full benefit.

Now lets get to the bones of the study. What is the rate of savings needed for a healthy retirement?

Ibbotson Table 1 [Click on the image for a larger view]

Ibbotson Table 1 [Click on the image for a larger view]

Table 1 shows the rate of savings needed assuming we do not have any past savings. Let us work out an example. Say our age is 35 and we are earning $60000 annually. Now say we want to save for a retirement that needs:

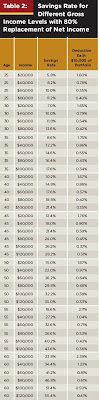

Now interestingly the scenario changes by a great deal if we have already saved some money for our retirement. Table 2 shows that this model really makes savings more achievable for all if we have already stowed away some retirement savings. Lets do the math.

Like our earlier example, say that our age is 35 and we are earning $60000 annually. But this time we have already saved around 30000 in our retirement accounts. So what is the rate of savings we need to get a retirement that needs:

If you already have some retirement savings, to calculate your current retirement savings from Table 2 do the following:

"The recommended savings rate for a person starting to save at age 25 typically more than doubles if they wait until age 45 to start saving, and triples if they wait until age 55 to start. We felt that people needed some guidelines so they have some idea as to what to save, and particularly younger people because younger people have far more years to plan. The earlier they start, the more wealth they will accumulate and it will be easier to actually meet those retirement goals."Here we also provide a snapshot of how the study came up with the figures for the capital needed for a single individual to retire.

"The recommended savings rate for a person starting to save at age 25 typically more than doubles if they wait until age 45 to start saving, and triples if they wait until age 55 to start. We felt that people needed some guidelines so they have some idea as to what to save, and particularly younger people because younger people have far more years to plan. The earlier they start, the more wealth they will accumulate and it will be easier to actually meet those retirement goals."Here we also provide a snapshot of how the study came up with the figures for the capital needed for a single individual to retire.

The capital needed to fund retirement at age 65 at various income levels is shown in Table 3. For example, if a person is at age 65 and just retired with a final salary of $100,000, his or her expected inflation-adjusted annual retirement income is $65,920 to provide the same lifestyle as their pre-retirement. Estimated Social Security benefits are $27,343 and the balance of $38,577 is distributed from savings. The last row in Table 3 is also the amount needed to buy the inflation-indexed lifetime fixed-payout annuities mentioned earlier [1].

We do have a concern with the calculation of the capital needed for retirement. What if by the time we retire, the Social Security Funds are no longer able to provide the desired benefits? In that case, in Table 3 (above) we have to provide for the cash inflow from social security from our own retirement savings which will make the savings rates go up. You might call us nuts, but being conservatives we will try to steer clear of social security benefits and try to save that amount in our retirement funds right now. So when we retire if we get the social security benefits, well and good. But if we do not get it then we are fine too since we made it a point to watch our backs early on.

The study is not fool proof. Nothing in our lives are! But at least it provides us with some customizable and realistic savings rates for our retirement instead of some general guidelines. It is like someone has suddenly given us a GPS en route to our retirement's nest egg. But we must remember that no GPS's algorithms are correct one hundred percent! Nevertheless it is one of the most useful tools of our electronic age.

The study is not fool proof. Nothing in our lives are! But at least it provides us with some customizable and realistic savings rates for our retirement instead of some general guidelines. It is like someone has suddenly given us a GPS en route to our retirement's nest egg. But we must remember that no GPS's algorithms are correct one hundred percent! Nevertheless it is one of the most useful tools of our electronic age.

We found this study very helpful and hopefully you will do the same. Let us know your views and opinions about it.

If our site interests you, please kindly extend your support by subscribing to our feed. This will help us to deliver our stories to your feed reader where you can read it with pleasure in your own sweet leisure.

If our site interests you, please kindly extend your support by subscribing to our feed. This will help us to deliver our stories to your feed reader where you can read it with pleasure in your own sweet leisure.

Reference(s)

Oct 20, 2008: The subprime mortgage fiasco's blow to the economy along with recent failures in the investment banking industry have led to closure of several big companies. Consequently we are seeing huge layoffs and a rise in unemployment rates. Times are difficult for those who have lost their jobs and also for those who have lost their homes. No matter what the causes are, people are going through tough times and our prayers are with them for overall well being in all aspects of life. Often we have seen that if we hold cheerful expectations from life sooner or later they become true. So let us all be enthusiastic about the economy bouncing back and people finding satisfying employment opportunities.

Oct 20, 2008: The subprime mortgage fiasco's blow to the economy along with recent failures in the investment banking industry have led to closure of several big companies. Consequently we are seeing huge layoffs and a rise in unemployment rates. Times are difficult for those who have lost their jobs and also for those who have lost their homes. No matter what the causes are, people are going through tough times and our prayers are with them for overall well being in all aspects of life. Often we have seen that if we hold cheerful expectations from life sooner or later they become true. So let us all be enthusiastic about the economy bouncing back and people finding satisfying employment opportunities. As Americans we often find ourselves in a tough spot of having the responsibility to save for a healthy retirement without any clear notion of how much to save. To add to that, layoffs or the time between jobs, often make it hard to save. There are certain rules of thumb about saving which can give a general guideline about saving:

As Americans we often find ourselves in a tough spot of having the responsibility to save for a healthy retirement without any clear notion of how much to save. To add to that, layoffs or the time between jobs, often make it hard to save. There are certain rules of thumb about saving which can give a general guideline about saving:- Save 10% of your salary

- Stow away as much of your pre-tax income so that you can get a full company match 401(k) contribution (provided your employer has a matching contribution 401(k) plan)

- CFP Christine Fahlund at T. Rowe Price advises to save 15 percent of our pretax salary

- For those of us who have delayed saving till late in life, Fahlund's advice is to save 25 percent

- CFP Robert Pagliarini prophesies to save the percentage that represents half our age. So if you're 30, save 15 percent; if you're 50, save 25 percent and so on.

The April issue of the Journal of Financial Planning features an interesting study: "National Savings Rate Guidelines for Individuals [1]". It takes into consideration age, income and retirement savings till date to compute the rate of saving required to reach a comfortable retirement. It also creates benchmarks for how much capital an individual would have accumulated based on their income and age, with the presumption that they started saving at age 35. Additionally, it shows targets for how much an individual should have accumulated at age 65, prior to retiring [2].

Your gross salary minus the amount you're putting away for retirement is defined as net pre-retirement income. The study calculates how much money you'll need in addition to Social Security income at age 65 to maintain your standard of living. The authors simplify matters by assuming full Social Security benefits are available at age 65. However, they urge readers to wait in reality until full retirement age to get the full benefit.

Now lets get to the bones of the study. What is the rate of savings needed for a healthy retirement?

Ibbotson Table 1 [Click on the image for a larger view]

Ibbotson Table 1 [Click on the image for a larger view]Table 1 shows the rate of savings needed assuming we do not have any past savings. Let us work out an example. Say our age is 35 and we are earning $60000 annually. Now say we want to save for a retirement that needs:

- 80% (of our current) income replacement:

- Required savings rate is 19.6%

- i.e. we need to save [19.6 * 60000/100] = $11760 annually or $980 monthly.

- 60% (of our current) income replacement:

- Required savings rate is 10.6%

- i.e. we need to save [10.6 * 60000/100] = $6360 annually or $530 monthly.

Now interestingly the scenario changes by a great deal if we have already saved some money for our retirement. Table 2 shows that this model really makes savings more achievable for all if we have already stowed away some retirement savings. Lets do the math.

Like our earlier example, say that our age is 35 and we are earning $60000 annually. But this time we have already saved around 30000 in our retirement accounts. So what is the rate of savings we need to get a retirement that needs:

- 80% (of our current) income replacement:

- our savings rate is [14.6 - (0.55 * 30000/10000)] = 12.95%

- i.e. we need to save [12.95 * 60000/100] = $7770 annually or $647.5 monthly.

If you already have some retirement savings, to calculate your current retirement savings from Table 2 do the following:

Find your age and income level to determine your appropriate savings rate.

Find your age and income level to determine your appropriate savings rate.- For each $10,000 you have in accumulated savings, subtract the number in the fourth column from the savings rate.

- For example if you are 35 years old, with an annual income of $60,000 and $30000 in retirement savings, subtract (0.55 * 30000/10000) from the savings rate of 14.6% to get your current required saving rate.

"The recommended savings rate for a person starting to save at age 25 typically more than doubles if they wait until age 45 to start saving, and triples if they wait until age 55 to start. We felt that people needed some guidelines so they have some idea as to what to save, and particularly younger people because younger people have far more years to plan. The earlier they start, the more wealth they will accumulate and it will be easier to actually meet those retirement goals."Here we also provide a snapshot of how the study came up with the figures for the capital needed for a single individual to retire.

"The recommended savings rate for a person starting to save at age 25 typically more than doubles if they wait until age 45 to start saving, and triples if they wait until age 55 to start. We felt that people needed some guidelines so they have some idea as to what to save, and particularly younger people because younger people have far more years to plan. The earlier they start, the more wealth they will accumulate and it will be easier to actually meet those retirement goals."Here we also provide a snapshot of how the study came up with the figures for the capital needed for a single individual to retire.The capital needed to fund retirement at age 65 at various income levels is shown in Table 3. For example, if a person is at age 65 and just retired with a final salary of $100,000, his or her expected inflation-adjusted annual retirement income is $65,920 to provide the same lifestyle as their pre-retirement. Estimated Social Security benefits are $27,343 and the balance of $38,577 is distributed from savings. The last row in Table 3 is also the amount needed to buy the inflation-indexed lifetime fixed-payout annuities mentioned earlier [1].

We do have a concern with the calculation of the capital needed for retirement. What if by the time we retire, the Social Security Funds are no longer able to provide the desired benefits? In that case, in Table 3 (above) we have to provide for the cash inflow from social security from our own retirement savings which will make the savings rates go up. You might call us nuts, but being conservatives we will try to steer clear of social security benefits and try to save that amount in our retirement funds right now. So when we retire if we get the social security benefits, well and good. But if we do not get it then we are fine too since we made it a point to watch our backs early on.

The study is not fool proof. Nothing in our lives are! But at least it provides us with some customizable and realistic savings rates for our retirement instead of some general guidelines. It is like someone has suddenly given us a GPS en route to our retirement's nest egg. But we must remember that no GPS's algorithms are correct one hundred percent! Nevertheless it is one of the most useful tools of our electronic age.

The study is not fool proof. Nothing in our lives are! But at least it provides us with some customizable and realistic savings rates for our retirement instead of some general guidelines. It is like someone has suddenly given us a GPS en route to our retirement's nest egg. But we must remember that no GPS's algorithms are correct one hundred percent! Nevertheless it is one of the most useful tools of our electronic age.We found this study very helpful and hopefully you will do the same. Let us know your views and opinions about it.

If our site interests you, please kindly extend your support by subscribing to our feed. This will help us to deliver our stories to your feed reader where you can read it with pleasure in your own sweet leisure.

If our site interests you, please kindly extend your support by subscribing to our feed. This will help us to deliver our stories to your feed reader where you can read it with pleasure in your own sweet leisure.Reference(s)

- Journal of Financial Planning: Roger Ibbotson, Ph.D., James Xiong, Ph.D., CFA, Robert P. Kreitler, CFP, Charles F. Kreitler and Peng Chen, Ph.D., CFA: "National Savings Rate Guidelines for Individuals"

- Bankrate: Whelehan, B.M : "Savings rate for a secure retirement"