The dawn of a new year is often accompanied with new dreams and rejuvenated hope. It also reminds us to get ready and contribute our share towards this great nation. How? By paying our taxes :).

As you might have noticed from our posts, we have been keeping an eye on deals for tax preparation software. We shall continue to do so until the D-day for filing taxes.

You Ask

One of our readers, Nick*, has emailed an interesting question:

"I just read this article (about an excellent deal from TaxAct) from your site and I was wondering if you were really able to eFile two state returns? I've only been able to eFile one in the past and I would love to be able to do two. Can you tell me how you did that?"*The reader's name has been changed to protect his privacy.

"I just read this article (about an excellent deal from TaxAct) from your site and I was wondering if you were really able to eFile two state returns? I've only been able to eFile one in the past and I would love to be able to do two. Can you tell me how you did that?"*The reader's name has been changed to protect his privacy.

We Reply

The need to file multiple state returns is quite common. Some reasons for it may be:

Now that should have been taxing. Surprisingly and fortunately it wasn't so. We had used TaxAct Online Ultimate Bundle and e-filed most of them.

Coming back to Nick's question: To e-file multiple state returns using TaxAct Online, please do the following:

Special Case

A couple of years ago we had an unique need. We had to file two state returns with different filing statuses - Married Filing Jointly(MFJ) and Married Filing Separately(MFS)!

The problem with TaxAct is that it does not allow the filing status (of a return) to be changed. The filing status is locked to one chosen for our federal filing. We sent an email to TaxAct and quote their response:

As you might have noticed from our posts, we have been keeping an eye on deals for tax preparation software. We shall continue to do so until the D-day for filing taxes.

You Ask

One of our readers, Nick*, has emailed an interesting question:

"I just read this article (about an excellent deal from TaxAct) from your site and I was wondering if you were really able to eFile two state returns? I've only been able to eFile one in the past and I would love to be able to do two. Can you tell me how you did that?"

"I just read this article (about an excellent deal from TaxAct) from your site and I was wondering if you were really able to eFile two state returns? I've only been able to eFile one in the past and I would love to be able to do two. Can you tell me how you did that?"We Reply

The need to file multiple state returns is quite common. Some reasons for it may be:

- relocation to a different state or a change of our domicile state

- a new job in a different state

- your spouse lives or works in a different state

Now that should have been taxing. Surprisingly and fortunately it wasn't so. We had used TaxAct Online Ultimate Bundle and e-filed most of them.

Coming back to Nick's question: To e-file multiple state returns using TaxAct Online, please do the following:

- Log in to TaxAct online.

- Enter data for federal return. You may e-file your federal return at this point or choose to do so later.

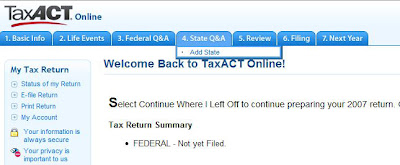

- Click on the tab "State Q & A" at the top. Next select "Add State." Enter data for the chosen state. Please see the image below.

- Repeat step #3 for another state.

- Revise all data.

- Whenever you are ready simply e-file Federal or any of the states as you desire.

Special Case

A couple of years ago we had an unique need. We had to file two state returns with different filing statuses - Married Filing Jointly(MFJ) and Married Filing Separately(MFS)!

The problem with TaxAct is that it does not allow the filing status (of a return) to be changed. The filing status is locked to one chosen for our federal filing. We sent an email to TaxAct and quote their response:

"If a taxpayer files as Married Filing Joint on the federal return, and wants to change to Married Filing Separate on the state return, TaxACT does not "exclude" income from the other spouse on the state return. The taxpayer would need to enter a new federal return with the MFS filing status and just enter the one spouse's income amounts, etc. to have that income and data transfer alone to the state return. This Married Filing Separate federal return would not be e-filed. The same procedure would be done for the second spouse if desired. Taxpayer can then individually e-file the Married Filing Joint return and the Married Filing Separate state return(s)."Based on above advice, we executed these steps last year:

- Entered federal and state data.

- e-filed both with same status - Married Filing Jointly.

- Downloaded pdf copies of all the e-filed returns.

- Saved a copy of pdf docs showing comparison with previous year's tax returns and national averages.

- Changed federal data and filing status to Married Filing Separately.

- Added a new state and entered data.

- Did NOT e-file federal return. Simply e-filed return for the second state. As expected, an additional fee was charged for the second state.