May 22, 2014: At times the fast pace of our city lives appear stifling, making us long for a slower pace of life with more exposure to clean air and green vegetation. Our souls yearn for a simple life which is in greater harmony with Mother Nature. Of late, our work related health problems have been making us yearn, almost every morning, for a more relaxed life with greater freedom.

May 22, 2014: At times the fast pace of our city lives appear stifling, making us long for a slower pace of life with more exposure to clean air and green vegetation. Our souls yearn for a simple life which is in greater harmony with Mother Nature. Of late, our work related health problems have been making us yearn, almost every morning, for a more relaxed life with greater freedom.So we were thrilled to read about Sandy Aldridge and Dale Lugenbehl who retired early (at ages 48 and 47 respectively) more than a dozen years ago to their eight-acre farm in Cottage Grove, Oregon. Though they did not have high paying jobs, their conscious choice and laser focus on leading a simple life with meaningful pursuits in a harmonious relationship with nature allowed them to kick the rat race early. Their philosophy was "living more simply so that others may simply live."

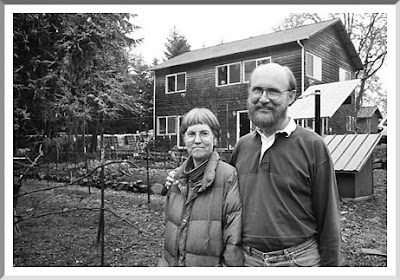

Sandy Aldridge and Dale Lugenbehl [1]

Sandy Aldridge and Dale Lugenbehl [1]They did not wait to become millionaires to retire early. Instead they retired early with a starting nest egg of $135,000 each (i.e. a total of $270,000). They spent $100,000 from their nest egg to buy the woodland and building materials for their present farm. A year's labor saw them building a 1,700-square-foot home that is heated by solar energy and a wood stove i.e. renewable sources of energy.

They conservatively invested the remainder (i.e. $170,000) of their money in Certificates of Deposits (CDs) which would pay about $10,000 to $12,000 a year in interest. Here we quote Sandy to explain their philosophy behind choosing CDs:

We like to sleep at night, so it's more important to us to know what's coming in, rather than to maximize the possible income. We've seen too many folks lose money rather than make money from their so-called investments.

Well at this stage of our lives, we could not have agreed more with Sandy since our portfolio lost more than 50% of its value! We are seriously thinking about investing in CDs and high yield savings accounts to preserve our capital and recuperate from current losses.

Coming back to Sandy and Dale's story, the interest from their CD's is more than enough to cover about $720 a month in living expenses - two-thirds of which goes for taxes and health, homeowners and auto insurance. They grow 85-90% of the food that they eat in a summer and winter garden and on 29 fruit trees. They cut each other's hair, don't have a television, shop for clothes at yard sales and rarely eat out. Yet Sandy says that they don't feel like their life is lacking. Her words express their contentment:

We are fortunate to have found what is enough for us. I feel so totally blessed with how much we have that I can't imagine wanting more. At this point, I'd have to say it's more than enough to meet our needs and our wants.

Sandy and Dale find joy in small construction and gardening projects on their property, cook their own meals from scratch and volunteer to give presentations on the environmental impact of food choices and sustainable agriculture. They also enjoy hiking and playing music with friends. Aldridge and Lugenbehl enjoy their day-to-day life so much that the thought of vacationing elsewhere rarely occurs to them. Often they end up teaching a couple of classes a year at their community college. But since they have retired, they choose to teach only those classes that interest them. According to Sandy:

Dale and I would both rather have our time, even if we end up choosing to work hard at gardening or building. At least we're the ones determining what we're going to do with our precious life energy.

Well said Sandy! Once we are depleted of our life force nothing in the world can replace it, not even money. We are observing that several of our relatives and friends who are nearing retirement are paying a heavy price for their roles in the rat race and king size lives. Work pressure and stress have taken their tolls on their health. Most of them complain about lack of energy brought about by declining life forces. As a consequence, they don't feel enthusiastic about their forthcoming retirements any more. Now they fear that they would be dealing with poor health and large medical bills in their golden years!

Having observed their lives we definitely don't want to design ours on those lines. We would rather lead a simple life with greater joy and health albeit less money. Dale summarizes it well for us:

We feel very wealthy. If your income is triple your expenses, that feels pretty comfortable. It's being able to get up each morning and decide for myself what I'm going to be doing that day. Honestly, I can't think of any downside; at least there hasn't been one for me.

How does Sandy and Dale inspire you towards your FIRE plans? Kindly leave a comment :). We look forward to reading your varied views and perspectives on FIRE.

References:

[1]. Sandy Aldridge & Dale Lugenbehl - Happening People.

[2]. Dare to Retire Before 50.

Image Source(s): iStockPhoto