Now a days, credit cards are hard to come by. With banks failing regularly, the banking sector is under scrutiny. As a result, consumers are facing new challenges for managing their finances. For many people caught in the mire of our present financial crisis, opening a new bank account, or getting a credit card, is next to impossible.

With credit cards becoming a difficult as well as an annoying commodity and the security of banks being a big question mark, the use of prepaid debit cards is on the rise. Now a days a consumer can pick up a plastic card worth $25, $100 or even $500 by simply walking into any major drugstore. A prepaid debit card enables shoppers to simply pay for the card at the cash register and then avail its facilities like ATM withdrawals, store purchases and online shopping. In short, a prepaid debit card carries the conveniences of a credit as well as a debit card without the annoyance of going through a credit check for getting it. Another advantage is that once its prepaid balance is over, it cannot be used as a credit card. In a way, its more like cash. Thus it prevents consumers from getting carried over into debt while using a credit card.

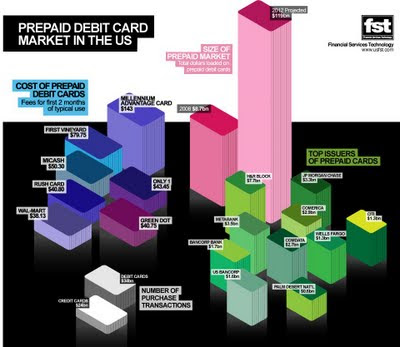

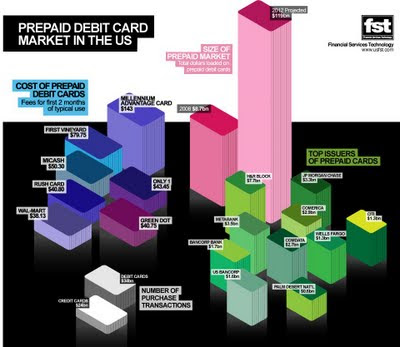

Consequently, the prepaid debit card market is poised for an explosion. Financial Services Technology (FST) has created a cool graphic visualization of how the prepaid debit card market is projected to explode from $8.7 billion loaded on the cards to $119 billion in 2012. A major chunk of this market comprises of the likes of American college students who do not want to carry cash, low income people and immigrants who have fewer financial options than their well do counterparts.

[Please click on the image to zoom in]

Come to think of it, a decade ago prepaid debit cards were barely in use while today they are the most attractive option to the roughly 80 million consumers who have little or no access to bank accounts! But there is a concern over the price tag that comes with all the niceties that a prepaid debit card offers.

The charges are small but incremental. For example, there is a fee of $1.75 for each ATM withdrawal, $1 for each ATM balance inquiry, 50 cents for each purchase, $4 for monthly maintenance and more. Usually the charges are within the fine print of the accompanying literature and are often overlooked by consumers. To an uninformed consumer, a prepaid debit card might become an expensive way of consuming or banking. Also, since the prepaid debit card industry is relatively new, it is yet to undergo the Congressional and regulatory scrutiny that credit and debit cards have gone through. However, once the industry is regulated, the cost of it will be passed on to the consumers in terms of higher fees making the prepaid debit cards more expensive. The downside of not having regulation is that consumers will have few legal protections to recover their money since there might be hidden fees associated with a prepaid debit card.

As an intelligent consumer, our next step might comprise of examining the cost of a prepaid debit card with that of using a balance checking and debit accounts.

In this scenario, The Network Branded Prepaid Card Association has released an interesting economic study conducted by Michael Flores of Bretton Woods which claims that:

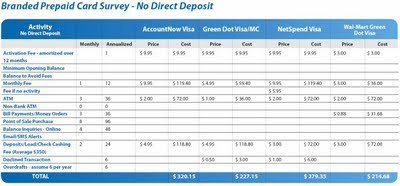

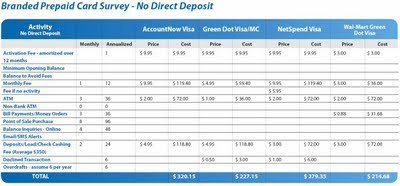

The following charts provide detail of the costs for basic checking accounts, check and cash services, and a branded prepaid card with and without direct deposit. An important point in this analysis is the inclusion of overdraft fees for checking accounts. Usually banks use a basic or free checking account to attract customers. Most banks earn revenues from overdraft fees. Bretton Woods published a report in January, 2009 analyzing overdraft fees and determined the average household with a checking account incurs one overdraft per month or twelve per year. The majority of fees are incurred by a minority of households who incur 4 overdraft per month or 48 per year. Since this study analyzes individual account/card holders rather than household usage, Bretton Woods reduced the number of annual overdrafts to six per year.

Cost of using basic checking accounts

[Please click on the image to zoom in]

Cost of using check and cash services

[Please click on the image to zoom in]

Cost of using a branded prepaid debit card with no direct deposit

[Please click on the image to zoom in]

Cost of using a branded prepaid debit card with direct deposit

[Please click on the image to zoom in]

The comparison reveals that:

Now a days, more mainstream banking consumers are adopting branded prepaid cards for unique purposes like budgeting, funding the spending needs of children, and receiving rebates from vendors (cash back in the form of prepaid debit visa or master cards) as incentives to purchase products. A branded prepaid card provides convenience and security to all that are far superior to cash though at a cost. For those who cannot get a credit card or a bank account, prepaid debit cards are proving to be a viable option for their money transaction needs. It's best to evaluate one's financial state and opt for the most cost effective solution for addressing the need of money transactions.

Let us know what you think of prepaid debit cards. We are looking forward towards your feedback and experiences.

With credit cards becoming a difficult as well as an annoying commodity and the security of banks being a big question mark, the use of prepaid debit cards is on the rise. Now a days a consumer can pick up a plastic card worth $25, $100 or even $500 by simply walking into any major drugstore. A prepaid debit card enables shoppers to simply pay for the card at the cash register and then avail its facilities like ATM withdrawals, store purchases and online shopping. In short, a prepaid debit card carries the conveniences of a credit as well as a debit card without the annoyance of going through a credit check for getting it. Another advantage is that once its prepaid balance is over, it cannot be used as a credit card. In a way, its more like cash. Thus it prevents consumers from getting carried over into debt while using a credit card.

Consequently, the prepaid debit card market is poised for an explosion. Financial Services Technology (FST) has created a cool graphic visualization of how the prepaid debit card market is projected to explode from $8.7 billion loaded on the cards to $119 billion in 2012. A major chunk of this market comprises of the likes of American college students who do not want to carry cash, low income people and immigrants who have fewer financial options than their well do counterparts.

Come to think of it, a decade ago prepaid debit cards were barely in use while today they are the most attractive option to the roughly 80 million consumers who have little or no access to bank accounts! But there is a concern over the price tag that comes with all the niceties that a prepaid debit card offers.

The charges are small but incremental. For example, there is a fee of $1.75 for each ATM withdrawal, $1 for each ATM balance inquiry, 50 cents for each purchase, $4 for monthly maintenance and more. Usually the charges are within the fine print of the accompanying literature and are often overlooked by consumers. To an uninformed consumer, a prepaid debit card might become an expensive way of consuming or banking. Also, since the prepaid debit card industry is relatively new, it is yet to undergo the Congressional and regulatory scrutiny that credit and debit cards have gone through. However, once the industry is regulated, the cost of it will be passed on to the consumers in terms of higher fees making the prepaid debit cards more expensive. The downside of not having regulation is that consumers will have few legal protections to recover their money since there might be hidden fees associated with a prepaid debit card.

As an intelligent consumer, our next step might comprise of examining the cost of a prepaid debit card with that of using a balance checking and debit accounts.

In this scenario, The Network Branded Prepaid Card Association has released an interesting economic study conducted by Michael Flores of Bretton Woods which claims that:

consumers who opt to use a network branded prepaid card could pay as much as 35-70% less in fees as compared to low balance checking and debit accounts, making prepaid cards a far more cost-effective, valuable financial tool for many.

[Please click on the image to zoom in]

[Please click on the image to zoom in]

[Please click on the image to zoom in]

[Please click on the image to zoom in]

The comparison reveals that:

- A typical consumer with a low balance checking account can expect to pay $200 to $350 annually in the form of overdraft fees, ATM fees, and minimum balance fees.

- Consumers using a system of money orders, check cashing and bill payment services can pay anywhere between $167 to $312 annually in various fees.

- A consumer using a prepaid debit card without direct deposit can pay $215 to $320 in annual fees.

- Users of prepaid debit card with direct deposit may pay between $108 to $207 in annual fees. For customers in the same income zone and usage patterns, this option may save a consumer about $96 to $146 over a basic checking account.

Now a days, more mainstream banking consumers are adopting branded prepaid cards for unique purposes like budgeting, funding the spending needs of children, and receiving rebates from vendors (cash back in the form of prepaid debit visa or master cards) as incentives to purchase products. A branded prepaid card provides convenience and security to all that are far superior to cash though at a cost. For those who cannot get a credit card or a bank account, prepaid debit cards are proving to be a viable option for their money transaction needs. It's best to evaluate one's financial state and opt for the most cost effective solution for addressing the need of money transactions.

Let us know what you think of prepaid debit cards. We are looking forward towards your feedback and experiences.