[This post is written and copyrighted by FIRE Finance (http://firefinance.blogspot.com).]

June 08, 2009: When we first started investing we got carried away by all the Wall Street hype. Without doing our homework we purchased individual technology stocks. Needless to say it was very risky and unwise to do so. Add to it the high brokerage fees that were prevalent in those days.

June 08, 2009: When we first started investing we got carried away by all the Wall Street hype. Without doing our homework we purchased individual technology stocks. Needless to say it was very risky and unwise to do so. Add to it the high brokerage fees that were prevalent in those days.We paid no attention to minimizing the management fees and simply went ahead and poured our money into the market! Neither were we aware of the issues involved in market timing.

Guiding Philosophy

Fortunately we became sensible very soon, in fact within a year! We started reading good books on long term investing. We contemplated on the philosophies and wisdom of investors who were successful over several decades. Soon we realized the value of having a healthy and balanced outlook in life - that includes all aspect of our daily lives including finances.

Fortunately we became sensible very soon, in fact within a year! We started reading good books on long term investing. We contemplated on the philosophies and wisdom of investors who were successful over several decades. Soon we realized the value of having a healthy and balanced outlook in life - that includes all aspect of our daily lives including finances.As a natural progression we developed our investing philosophies and since then followed them with discipline and diligence. We switched over to index investing - best expected return over long run with least amount of sweating. Besides it is ideal for investors starting out with small amount of money and yet achieve a broad market coverage with relatively lower risks.

Action

We figured that the investing steps we needed to follow were:

- Determine the indexes to invest in.

- Choose the index mutual funds to purchase that track the selected indexes.

- Recent years have produced another opportunity - Yes ETFs

- Evaluate the merits of switching over to an ETF instead of an index mutual fund.

- Seek out the appropriate ETFs.

Instead of going into the details of each index and then arriving at the summary we would take a reverse approach to this issue. We would like to present the overall summary first. That way readers can focus only on the family of indexes they are interested in.

Overall Coverage

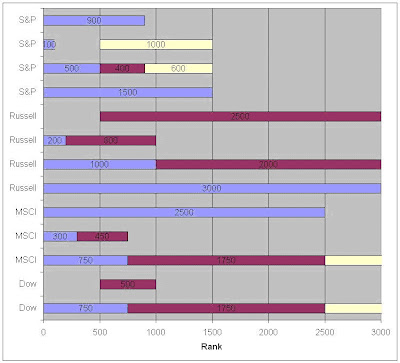

The following chart shows the major family of indexes for the US domestic market along the vertical axis. The horizontal axis depicts the ranks of US equities as defined by its market capitalization. Higher the rank the smaller is its market capitalization. The rank increases from left to right. Thus the large cap companies are on the left and the micro caps are on the extreme right.

Some key points to note

- Each family defines its own definition of Large Cap, Mid Cap, Small Cap and Micro Cap.

- Each family has its own mathematical model or definition of calculating an index.

- Choosing multiple indexes from different families would almost certainly lead to overlapping of assets thereby causing redundant coverage.

- The name of an index may not reveal much information. One ought to look under the hood at its definition and what it covers.

Image Source(s): iStockPhoto