Mint - "Refreshing Money Management" has gone live today. Earlier today, Aaron Patzer, Founder & CEO, of Mint sent us a note informing about the unveiling of this great venture at TechCrunch40, San Francisco.

According to Aaron, Mint is a “revolutionary” yet painlessly simple way for organizing our finances. It offers FREE accounts to users who can maintain their anonymity and get their financial house in shape. There is no need to furnish your name, SSN or address. All you need is a valid email id and a password.

Features

All your finances in one place: View all of your banking and credit card transactions side-by-side. This helps in identifying all of your transactions much easier and faster than ever before. Mint even lets you label your transactions so you know what bills you need to split with your friends or roommates, know which ones need to be reimbursed for your company, and more.

Know your financial health: You can check the balances on all your credit cards and bank accounts at the same time. No more logging into multiple online banking sites or balancing your checkbooks. Mint also helps you to compare your cash and debt so you know at-a-glance how you are doing financially.

Automatic Updates: Mint supports 3,000 US banks and credit card companies. Once an account is added, Mint automatically keeps it balanced and up-to-date forever. So all your transactions and balances are all in one place. In addition, Mint will send alerts if anything looks fishy in your accounts, saving you time and hassle.

Track Where Your Money Goes: Your transactions will be automatically categorized so that you know immediately how much you’re spending on food, gas, groceries, entertainment, and more. Mint has nice pie charts which give a complete overview of all spending.

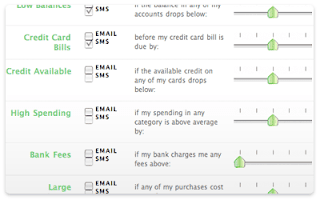

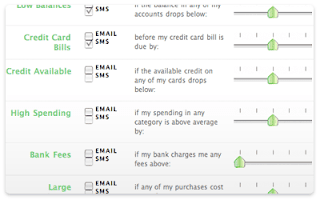

Set Alerts: Mint has an easy-to-use and customizable alert system. You can get alerts via e-mail or text messages for low balances in any checking/savings account, credit card bill due dates and so on.

Save Money By Availing Special Deals: Based on your spending habits, Mint will try to find a better deal than what you currently have for your bank accounts and credit cards. You could choose from several providers and compare their offerings.

That is more or less the gist of Mint's offerings. The website's presentation is sleek. But to many of us it looks like old wine in a new bottle. Mint replicates most of the features of an erstwhile similar site named LowerMyBills.com. Sadly this site is closed now.

But Mint has added new useful features (which were not present at LowerMyBills.com) like automatic fetching of the transactions from your bank and credit cards and categorizing them. This is a painful task and we are grateful that Mint automated it. Also, there are subtler tweaks at Mint which are great like automatic categories, exclusive banking and credit card deals and more.

Our experience at Mint has not been smooth. We tried to register some of our credit card accounts several times. Each time Mint could not fetch the cards' data electronically. Perhaps their servers are overloaded due to the company's official release today.

We feel that this company has great potential (even though there were server glitches today) and perhaps will go a long way in leveraging the power of the web in organizing personal finances in a painless yet secure way.

If you have been using Mint, we are looking forward towards hearing about your "Minty" experiences.

According to Aaron, Mint is a “revolutionary” yet painlessly simple way for organizing our finances. It offers FREE accounts to users who can maintain their anonymity and get their financial house in shape. There is no need to furnish your name, SSN or address. All you need is a valid email id and a password.

Features

All your finances in one place: View all of your banking and credit card transactions side-by-side. This helps in identifying all of your transactions much easier and faster than ever before. Mint even lets you label your transactions so you know what bills you need to split with your friends or roommates, know which ones need to be reimbursed for your company, and more.

Know your financial health: You can check the balances on all your credit cards and bank accounts at the same time. No more logging into multiple online banking sites or balancing your checkbooks. Mint also helps you to compare your cash and debt so you know at-a-glance how you are doing financially.

Automatic Updates: Mint supports 3,000 US banks and credit card companies. Once an account is added, Mint automatically keeps it balanced and up-to-date forever. So all your transactions and balances are all in one place. In addition, Mint will send alerts if anything looks fishy in your accounts, saving you time and hassle.

Track Where Your Money Goes: Your transactions will be automatically categorized so that you know immediately how much you’re spending on food, gas, groceries, entertainment, and more. Mint has nice pie charts which give a complete overview of all spending.

Set Alerts: Mint has an easy-to-use and customizable alert system. You can get alerts via e-mail or text messages for low balances in any checking/savings account, credit card bill due dates and so on.

Save Money By Availing Special Deals: Based on your spending habits, Mint will try to find a better deal than what you currently have for your bank accounts and credit cards. You could choose from several providers and compare their offerings.

That is more or less the gist of Mint's offerings. The website's presentation is sleek. But to many of us it looks like old wine in a new bottle. Mint replicates most of the features of an erstwhile similar site named LowerMyBills.com. Sadly this site is closed now.

But Mint has added new useful features (which were not present at LowerMyBills.com) like automatic fetching of the transactions from your bank and credit cards and categorizing them. This is a painful task and we are grateful that Mint automated it. Also, there are subtler tweaks at Mint which are great like automatic categories, exclusive banking and credit card deals and more.

Our experience at Mint has not been smooth. We tried to register some of our credit card accounts several times. Each time Mint could not fetch the cards' data electronically. Perhaps their servers are overloaded due to the company's official release today.

We feel that this company has great potential (even though there were server glitches today) and perhaps will go a long way in leveraging the power of the web in organizing personal finances in a painless yet secure way.

If you have been using Mint, we are looking forward towards hearing about your "Minty" experiences.