[This post is written and copyrighted by FIRE Finance (http://firefinance.blogspot.com).]

Sep 15, 2008: We still remember the shock that enveloped us as September 11 unfolded itself in 2001. The fragility of life and our helplessness depicted the puny of our planning in the face of destiny. Last week as another September 11 passed by we paused for a while to see what we had learnt in these seven years.

Sep 15, 2008: We still remember the shock that enveloped us as September 11 unfolded itself in 2001. The fragility of life and our helplessness depicted the puny of our planning in the face of destiny. Last week as another September 11 passed by we paused for a while to see what we had learnt in these seven years.

Since this blog is dedicated to personal finance we will limit our contemplations to investments, money and assets. Seven years ago we used to live in Silicon Valley (aka San Francisco Bay Area). It is one of the most expensive metropolitan areas of US. As young professionals, earning high salaries straight out of college, we thought we had arrived! Life was a bed of roses until we watched the horrific events on TV. It shook us to the core.

One of the most poignant questions that arose in our minds was "In case we were to meet with sudden death somewhere in this journey called life, is our family taken care of financially?" We know that the emotional turmoil arising with the death of a dear one cannot be eased with money. But the stress of living and paying bills can be greatly relieved for loved ones if our financial house is in order.

One of the most poignant questions that arose in our minds was "In case we were to meet with sudden death somewhere in this journey called life, is our family taken care of financially?" We know that the emotional turmoil arising with the death of a dear one cannot be eased with money. But the stress of living and paying bills can be greatly relieved for loved ones if our financial house is in order.

Till Sep 11, 2001, our lives had been following a repetitive pattern of "Work, Chores, Party, Eat, Sleep". But now we wondered "What is the shape of our financial house?"

Delving into our financial house we saw that we had no investments, retirement accounts (401(k)s / IRAs), a dedicated emergency fund, budgets and expense tracking. But fortunately there were a few positive facts on our side were:

We made a resolve to straighten out things no matter how hard it was. In a disciplined way, we started studying about investing and building a nest egg for retirement. After much reading we laid out our investing philosophy. To summarize, we decided to become long term players i.e. buy and hold, and invest systematically every year without trying to time the market.

We made a resolve to straighten out things no matter how hard it was. In a disciplined way, we started studying about investing and building a nest egg for retirement. After much reading we laid out our investing philosophy. To summarize, we decided to become long term players i.e. buy and hold, and invest systematically every year without trying to time the market.

An observation from the aftermath of September 11 was that many of our colleagues and friends had sold off their investments based on fear. Panic had driven the market down to dizzy depths.

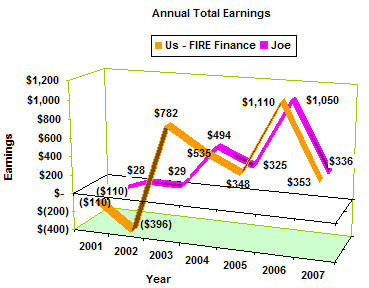

Now as a hindsight contemplation, we did a small exercise to see how well our investing guidelines have stood the test of time. To keep the case study simple we chose the following:

We observe that over a period of 6.75 years where both parties have invested $7000 ($1000 every year), our earnings are higher than that of Joe's by $469.23 which amounts to 6.7%. Can you imagine how large this figure will be in dollars when we study the scenario for a period of 30 or more years with hundreds of thousands of dollars (our nest egg) at stake?

We observe that over a period of 6.75 years where both parties have invested $7000 ($1000 every year), our earnings are higher than that of Joe's by $469.23 which amounts to 6.7%. Can you imagine how large this figure will be in dollars when we study the scenario for a period of 30 or more years with hundreds of thousands of dollars (our nest egg) at stake?

Also, it is be noted that Joe has chosen a simple algorithm for timing the market. Many people choose complex market timing strategies for which the case studies become increasingly difficult. But experience and advice from experts have time and again proven that over long term it does not pay to time the market. Consequently we note that our guiding philosophy of buy and hold with as few movements (in the portfolio) as possible has kept us in good stead.

At present, the stock market has taken a plunge. In this scenario, fear and panic driven behavior will perhaps lead to losses and subsequent stresses as well as regrets. Our past experience (aka post 9/11 studies and practice) has shown that steady disciplined investing with a good asset allocation often helps to ride out the bear market and emerge stronger when the bull is raring. We are looking forward towards hearing your experiences with the bear and the bull!

And if our site interests you, please kindly extend your support by subscribing to our feed. This will help us to deliver our stories to your feed reader where you can read it with pleasure in your own sweet leisure.

And if our site interests you, please kindly extend your support by subscribing to our feed. This will help us to deliver our stories to your feed reader where you can read it with pleasure in your own sweet leisure.

Reference(s):

Sep 15, 2008: We still remember the shock that enveloped us as September 11 unfolded itself in 2001. The fragility of life and our helplessness depicted the puny of our planning in the face of destiny. Last week as another September 11 passed by we paused for a while to see what we had learnt in these seven years.

Sep 15, 2008: We still remember the shock that enveloped us as September 11 unfolded itself in 2001. The fragility of life and our helplessness depicted the puny of our planning in the face of destiny. Last week as another September 11 passed by we paused for a while to see what we had learnt in these seven years.Since this blog is dedicated to personal finance we will limit our contemplations to investments, money and assets. Seven years ago we used to live in Silicon Valley (aka San Francisco Bay Area). It is one of the most expensive metropolitan areas of US. As young professionals, earning high salaries straight out of college, we thought we had arrived! Life was a bed of roses until we watched the horrific events on TV. It shook us to the core.

One of the most poignant questions that arose in our minds was "In case we were to meet with sudden death somewhere in this journey called life, is our family taken care of financially?" We know that the emotional turmoil arising with the death of a dear one cannot be eased with money. But the stress of living and paying bills can be greatly relieved for loved ones if our financial house is in order.

One of the most poignant questions that arose in our minds was "In case we were to meet with sudden death somewhere in this journey called life, is our family taken care of financially?" We know that the emotional turmoil arising with the death of a dear one cannot be eased with money. But the stress of living and paying bills can be greatly relieved for loved ones if our financial house is in order.Till Sep 11, 2001, our lives had been following a repetitive pattern of "Work, Chores, Party, Eat, Sleep". But now we wondered "What is the shape of our financial house?"

Delving into our financial house we saw that we had no investments, retirement accounts (401(k)s / IRAs), a dedicated emergency fund, budgets and expense tracking. But fortunately there were a few positive facts on our side were:

- we were young, so it was not too late to get started on setting our financial house in order

- no debt - all our credit cards balances were paid off each month

- some money in savings accounts with high APYs

We made a resolve to straighten out things no matter how hard it was. In a disciplined way, we started studying about investing and building a nest egg for retirement. After much reading we laid out our investing philosophy. To summarize, we decided to become long term players i.e. buy and hold, and invest systematically every year without trying to time the market.

We made a resolve to straighten out things no matter how hard it was. In a disciplined way, we started studying about investing and building a nest egg for retirement. After much reading we laid out our investing philosophy. To summarize, we decided to become long term players i.e. buy and hold, and invest systematically every year without trying to time the market.An observation from the aftermath of September 11 was that many of our colleagues and friends had sold off their investments based on fear. Panic had driven the market down to dizzy depths.

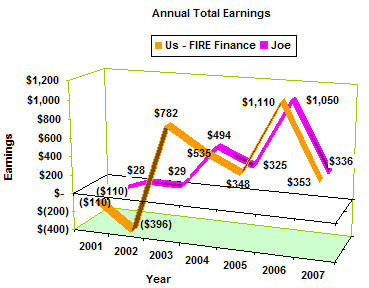

Now as a hindsight contemplation, we did a small exercise to see how well our investing guidelines have stood the test of time. To keep the case study simple we chose the following:

- Two persons are investing: Our "conservative market timer" friend Joe (a fictitious name) and ourselves

- For simplicity:

- We have chosen Vanguard's Total Stock Market Index (VTSMX) as the investing vehicle

- Each person invests $1000 at the beginning of the calendar year starting in 2001

- Both parties are using a brokerage firm where VTSMX is offered as a no load no transaction fee (NLNTF) mutual fund. This eliminates the need to track transaction fees for this case study.

- Investment strategies:

- Ours is to buy and hold

- Joe tries to time the market (conservatively) with the following philosophy:

- At the beginning of a year, Joe checks VTSMX's total returns for the past year. If it is less than the current APY offered by a 1 year CD, he sells off his investments in VTSMX and buys a CD. Else he invests in VTSMX.

- Our annual earnings from beginning of 2001 till 2007.

- Joe's annual earnings from beginning of 2001 till 2007.

- A graph showing the comparison of annual earnings over the span of 6.75 years from 2001 till 2007.

We observe that over a period of 6.75 years where both parties have invested $7000 ($1000 every year), our earnings are higher than that of Joe's by $469.23 which amounts to 6.7%. Can you imagine how large this figure will be in dollars when we study the scenario for a period of 30 or more years with hundreds of thousands of dollars (our nest egg) at stake?

We observe that over a period of 6.75 years where both parties have invested $7000 ($1000 every year), our earnings are higher than that of Joe's by $469.23 which amounts to 6.7%. Can you imagine how large this figure will be in dollars when we study the scenario for a period of 30 or more years with hundreds of thousands of dollars (our nest egg) at stake?Also, it is be noted that Joe has chosen a simple algorithm for timing the market. Many people choose complex market timing strategies for which the case studies become increasingly difficult. But experience and advice from experts have time and again proven that over long term it does not pay to time the market. Consequently we note that our guiding philosophy of buy and hold with as few movements (in the portfolio) as possible has kept us in good stead.

At present, the stock market has taken a plunge. In this scenario, fear and panic driven behavior will perhaps lead to losses and subsequent stresses as well as regrets. Our past experience (aka post 9/11 studies and practice) has shown that steady disciplined investing with a good asset allocation often helps to ride out the bear market and emerge stronger when the bull is raring. We are looking forward towards hearing your experiences with the bear and the bull!

And if our site interests you, please kindly extend your support by subscribing to our feed. This will help us to deliver our stories to your feed reader where you can read it with pleasure in your own sweet leisure.

And if our site interests you, please kindly extend your support by subscribing to our feed. This will help us to deliver our stories to your feed reader where you can read it with pleasure in your own sweet leisure.Reference(s):

- Yahoo Finance: VTSMX Performance

- Bankrate: 10 year chart for key interest rates