[This post is written and copyrighted by FIRE Finance (http://firefinance.blogspot.com).]

This week we focus on Everbank's FreeNet Checking Account in our series on Online Checking. For the past couple of years we have been using this product from Everbank. They are a superb bank, constantly innovating and providing a smooth as well as a streamlined online banking experience. But it comes at a price, please read on to discover it.

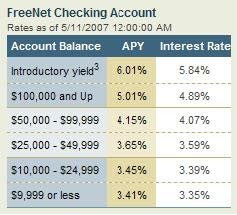

This week we focus on Everbank's FreeNet Checking Account in our series on Online Checking. For the past couple of years we have been using this product from Everbank. They are a superb bank, constantly innovating and providing a smooth as well as a streamlined online banking experience. But it comes at a price, please read on to discover it.In Nov 2006, Kiplinger had rated Everbank's FreeNet Checking as the "Best Checking Account". Everbank uses an attractive bait of an introductory 6.01% APY for the first three months. This trick attracts and then successfully hooks many first time customers to the FreeNet Checking account. After the introductory 6.01 % APY the rate card for various balances is shown below.

Highlights

Highlights- Everbank makes a Yield Pledge, where they pledge that your yield will be within the top 5% of competitive accounts available from leading banks.

- Complimentary online account management with the EverBank Online Financial Center.

- Optional Online Bill Pay with no fees when you maintain a minimum $1,500 balance in your FreeNet Checking Account ($4.95 monthly fee applies to balances below minimum).

- FREE unlimited check writing.

- First set of 50 checks FREE.

- View canceled checks online.

- No EverBank ATM surcharge fees.

- Reimbursement of ATM Fees ( charged by other financial institutions) up to $6 per month.

- Transfer funds for FREE between your EverBank accounts and non-EverBank accounts.

- View your non-EverBank accounts including credit cards, rewards programs, loans, 401k accounts, and investments.

- View and manage all of your EverBank Banking, World Markets and Non-FDIC insured EverTrade® Direct Brokerage accounts from one convenient site.

- More Info...

Everbank is FDIC insured and has a 4 star rating by Bankrate which means that it is a sound financial institution. If you wish, you may further check its credentials and performance using the steps listed here.

Everbank is FDIC insured and has a 4 star rating by Bankrate which means that it is a sound financial institution. If you wish, you may further check its credentials and performance using the steps listed here.FreeNet Checking from Everbank meets the needs of "writing checks" as well as doing online checking. But there are some caveats as well:

- It is to be noted that we have to maintain a minimum balance of $1500 to avoid the monthly fees of $4.95! This is a pretty steep climb for those who are looking for online banking with low or zero minimum balances.

- After the introductory 6.01% APY is over, the APY for balances less than $9999 is 3.41% ONLY. Since no one plans to keep $9k in a checking account, for all practical purposes the APY for FreeNet Checking is 3.41%.

Excepting the above mentioned disadvantages of a FreeNet Checking account, there are many positive aspects including a wonderful online interface and tonnes of bells and whistles. The best part is Everbank's 24 hour customer service where we get to speak to a human being immediately (instead of going through rounds of automated voice software or writing emails and waiting for replies). We have had excellent responses from their customer service. Must admit that they have never given us a reason to complain so long as we remained within their rules and regulations.

But it is to be noted that these guys are sticklers to their policy. They are not flexible enough to adapt to a customer's needs which are not clearly specified in their policy documents. The customer has to bend themselves to adapt to their policies.

Well you win some and you lose some, nothing in this world is perfect!

Next week we shall delve into the analysis of another online checking product. So what will be the new surprise? Join us next week for the fourth part of this series.

The Series So Far: