[This post is written and copyrighted by FIRE Finance (http://firefinance.blogspot.com).]

Retirement planning is one of the most important things that we will ever do. Despite its importance, some people procrastinate because they worry it will be hard, or stressful. Well now we can relax since Etrade has come up with a visual, interactive, and easy to use online software for retirement planning. Best of all, it's absolutely FREE. We need not have an account with Etrade to use this tool.

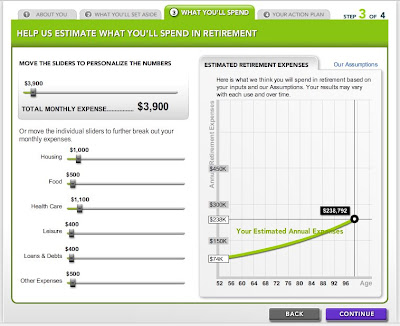

Retirement planning is one of the most important things that we will ever do. Despite its importance, some people procrastinate because they worry it will be hard, or stressful. Well now we can relax since Etrade has come up with a visual, interactive, and easy to use online software for retirement planning. Best of all, it's absolutely FREE. We need not have an account with Etrade to use this tool.To make sure that we're on track for the retirement that we deserve, it might pay off to invest a few minutes, right now. E*TRADE has made it easy with Retirement QuickPlan – the no-stress, no-hassle retirement planning tool.

- In just a few clicks, we can see if we’re on track

- In about 10 minutes we can create a personalized action plan

In the next step we are guided to our savings and investment styles by entering data into a sleek yet intuitive interface. Personalized data about our age, state of residence, planned retirement age, household income, social security estimate, savings and investments to date, monthly savings and portfolio's investment style are taken as inputs. Based on these data the tool projects our nest egg's growth and its value at our age of retirement. The projections are presented as a graph with the nest egg's value in the vertical axis and our age on the horizontal axis. Etrade uses several assumptions to arrive at this value. We can go through their assumptions via a hyperlink at the base of the graph.

In the final step of our retirement planning, Etrade's Retirement Quickplan projects the value of our nest egg at the beginning of our retirement based on our current savings and investment plan. It also predicts an amount that we would most likely need for our retirement. Using our nest egg's value and the predicted requirement for our retirement Quickplan draws a bar graph to show us whether our nest egg would fall short or have excess. Then it generates a personalized plan of action with suggestions for improving our retirement plan.

Etrade's Quickplan has an intuitive user-interface and is easy to use. It is definitely a great tool to get started on retirement planning. We can play around with various input data to fine tune our action plan. To get a handle on the rate of savings needed to build a healthy nest egg check out Secure Retirement - At what rate should you save for it?

We look forward towards your experiences and feedback with this new retirement planning tool from Etrade. All the best for building a great nest egg!

Related: